How Much Does A Defensive Driving Course Reduce Insurance

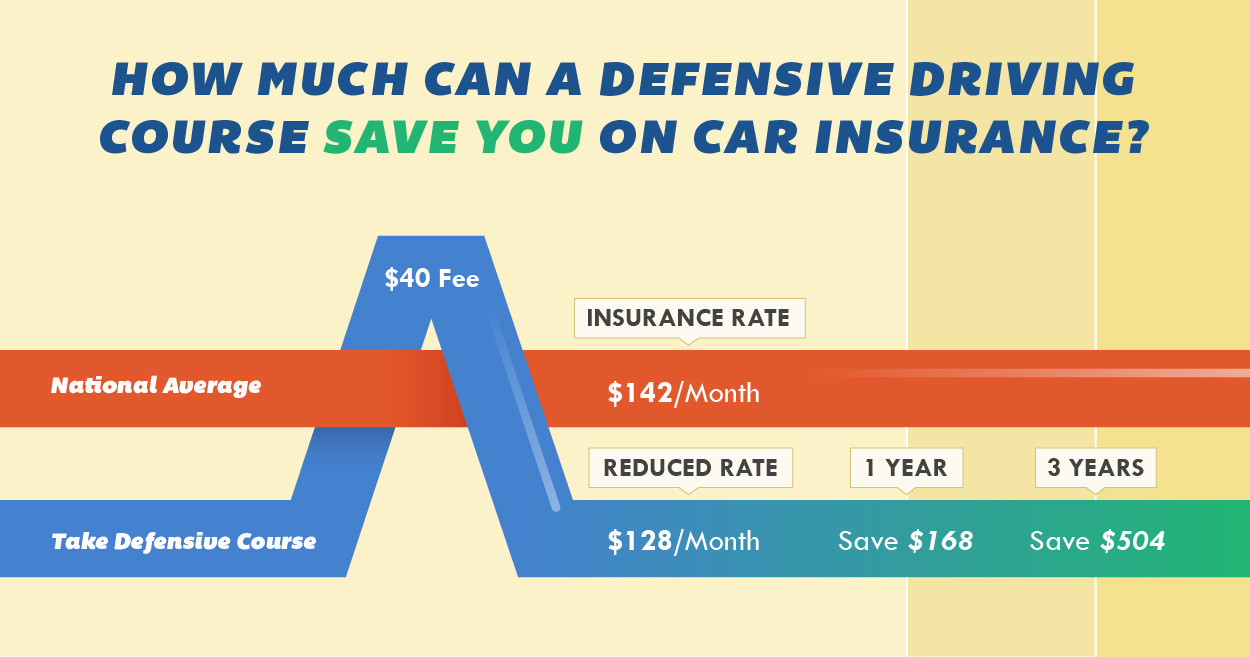

How Much Does A Defensive Driving Course Reduce Insurance - The courses usually take four to eight hours throughout an afternoon or weekend, and they cover safety information, driving techniques and local driving laws. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's defensive driving course or a motor vehicle accident prevention course. How much does the illinois traffic school defensive driving course cost? Although some insurance providers offer a defensive driving discount, most reserve this discount for older drivers.this discount varies by provider but typically ranges from 5% to 10%. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. But generally, if an insurer offers a discount, it’s between 5% and 20%, and typically lasts three to five years. Allstate offers up to 10% off for three years after course completion. How much can you save with a defensive driving insurance discount? The less time you’re on the road, the lower the risk and insurers often reward that. A defensive driving course typically lasts six to eight hours. Many insurance providers consider a defensive driving course to be a driver safety course, and taking them can give you savings ranging from 5% to 20% off your annual auto insurance cost. To qualify for a defensive driver car insurance discount, research insurance providers, take and pass approved courses, and notify your insurer about course completion. Learn about essential defensive driving techniques, how they mitigate risks, and the direct impact on your rates. Most often, drivers can expect a discount of about 10%. The actual amount of the discount will vary based on your insurer, age, state, and other factors. Many insurance companies provide discounts to drivers who take defensive driving classes, and the discounts typically range from 5% to 20% off your car insurance premium. How much can a defensive driving course lower your car insurance? You enrolled in a defensive driving course for $40. In general, you can expect to pay between $20 and $50. Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. Some states require insurers to offer a discount for taking a defensive driving course, so it’s worth checking if this applies to you. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Driving under the influence is a dangerous and expensive mistake. What payment options are available for. Why should i take this illinois traffic school defensive driving course? Completing an approved defensive driving course typically results in a car insurance discount that lasts for three years. Upon completion, you’re given a 10% discount on your auto insurance premiums. The less time you’re on the road, the lower the risk and insurers often reward that. The cost of. Car insurance companies would always like you to be a safer driver. Will i get an insurance discount after taking the illinois traffic school course? The courses usually take four to eight hours throughout an afternoon or weekend, and they cover safety information, driving techniques and local driving laws. But generally, if an insurer offers a discount, it’s between 5%. Although some insurance providers offer a defensive driving discount, most reserve this discount for older drivers.this discount varies by provider but typically ranges from 5% to 10%. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's defensive driving course or a motor. Completing a defensive driving course can help you save on auto insurance if your insurer offers a defensive driver discount. How much do you save on car insurance with defensive driving discounts? To qualify for a defensive driver car insurance discount, research insurance providers, take and pass approved courses, and notify your insurer about course completion. In general, you can. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's defensive driving course or a motor vehicle accident prevention course. So how much does taking a defensive driving course lower your insurance rates? While it can be harder for teens to find this. Most often, drivers can expect a discount of about 10%. But generally, if an insurer offers a discount, it’s between 5% and 20%, and typically lasts three to five years. Drivers who take defensive driving classes or have a clean driving record may even qualify for car insurance discounts. Completing a defensive driving course can help you save on auto. Some states require insurance companies to offer a discount for taking a defensive driving course, but every state has different rules. Allstate offers up to 10% off for three years after course completion. Progressive founded in 1937, progressive is the third largest personal car insurer in the u.s. Once you have completed the course, you should receive a discount between. The average cost of car insurance in texas after one dwi is $3,246, an increase of $1,203.multiple dwis come with increased penalties and much higher car insurance rates for years. How much can a defensive driving course lower your car insurance? Both online defensive driving course and classroom traffic school will generally cover topics including: Defensive driving discounts offered by. While discounts vary by state and insurance provider, here’s what drivers typically receive: Defensive driving discounts can vary depending on the state you’re in and the insurance company you choose. Completing an approved defensive driving course typically results in a car insurance discount that lasts for three years. Although some insurance providers offer a defensive driving discount, most reserve this. Driving under the influence is a dangerous and expensive mistake. Both online defensive driving course and classroom traffic school will generally cover topics including: How much does a defensive driving course save on insurance? The less time you’re on the road, the lower the risk and insurers often reward that. Please contact your insurance provider for more information and to check if a discount applies to you. We work closely with major insurance providers to ensure our course meets their criteria for discounts. The courses usually take four to eight hours throughout an afternoon or weekend, and they cover safety information, driving techniques and local driving laws. If you don’t drive as much, you could qualify for a discount. The cost of a defensive driving course varies by state and course provider. As a safe driver, you could enjoy a discount on your auto insurance policy through farmers insurance when you complete an online defensive driving course. Once you have completed the course, you should receive a discount between 5% and 15%, which lasts for three years with most insurers. Although some insurance providers offer a defensive driving discount, most reserve this discount for older drivers.this discount varies by provider but typically ranges from 5% to 10%. In general, you can expect to pay between $20 and $50. Some states require insurance companies to offer a discount for taking a defensive driving course, but every state has different rules. Car insurance companies would always like you to be a safer driver. Some states require insurers to offer a discount for taking a defensive driving course, so it’s worth checking if this applies to you.Does a defensive driving course lower your insurance costs?

Can Defensive Driving Training Lower Your Car Insurance

Cost of Defensive Driving Classes What to Expect The Wiser Driver

Defensive Driving Course Remedial Improved Driving Program

Are Defensive Driving Courses Worth the Money? QuoteWizard

Does Taking a Defensive Driving Course Lower Insurance?

Senior Defensive Driving Course Save Money on Car Insurance Lake

Defensive Driving Course for Automobile Insurance Reduction/Point

How Much Does a Defensive Driving Course Save on Insurance?

Cost of Defensive Driving Classes What to Expect The Wiser Driver

Completing A Defensive Driving Course Can Lead To Substantial Financial Benefits.

How Much Can A Defensive Driving Course Lower Your Car Insurance?

Learn About Essential Defensive Driving Techniques, How They Mitigate Risks, And The Direct Impact On Your Rates.

To Qualify For A Defensive Driver Car Insurance Discount, Research Insurance Providers, Take And Pass Approved Courses, And Notify Your Insurer About Course Completion.

Related Post: