Real Estate Underwriting Courses

Real Estate Underwriting Courses - Up to 10% cash back real estate analyst and underwriting is the process of reviewing a loan application to determine the amount of risk involved. This online course reviews the. Real estate agent tipsfree coaching call220 new millionaires madecoaching since 2014 5+ years of commercial real estate underwriting experience, or equivalent demonstrated through one or a combination of the following: The analyst will look at the borrower's. Perform simple, preliminary development project evaluations from start. Campusunderwriter® is the online mortgage training provider for the national association of mortgage processors® (namp®) and the national association of mortgage underwriters®. Acquire the specialized lending skills to structure real estate construction loans and. A mortgage underwriter must analyze a potential borrower's income, assets, liabilities, and other factors to determine if the potential borrower not only meets the requirements for a mortgage,. Gain tangible skills when you enroll in the certified residential underwriter (cru) certificate and designation program. As you work your way through the. Campusunderwriter® is the online mortgage training provider for the national association of mortgage processors® (namp®) and the national association of mortgage underwriters®. At the national association of mortgage underwriters we offer a comprehensive mortgage underwriter bootcamp which includes online mortgage training classes to mortgage. The analyst will look at the borrower's. 5+ years of commercial real estate underwriting experience, or equivalent demonstrated through one or a combination of the following: Gain tangible skills when you enroll in the certified residential underwriter (cru) certificate and designation program. A mortgage underwriter must analyze a potential borrower's income, assets, liabilities, and other factors to determine if the potential borrower not only meets the requirements for a mortgage,. At the national association of mortgage underwriters we offer online mortgage underwriting training, certification and education. Up to 10% cash back real estate analyst and underwriting is the process of reviewing a loan application to determine the amount of risk involved. Our progressive curriculum establishes the standard for professional excellence in residential mortgage loan underwriting. The underwriting process, a cornerstone of commercial real estate investment and finance, also stands to benefit immensely from ai integration. Learn how to underwrite more complex real estate deals involving office, retail, and industrial loans. Expertise in private equity real estate underwriting, structuring, and execution. Real estate agent tipsfree coaching call220 new millionaires madecoaching since 2014 Acquire the specialized lending. Up to 10% cash back real estate analyst and underwriting is the process of reviewing a loan application to determine the amount of risk involved. Gain tangible skills when you enroll in the certified residential underwriter (cru) certificate and designation program. This online course reviews the. Completion of this program along with the prerequisites results in the award of. As. A mortgage underwriter must analyze a potential borrower's income, assets, liabilities, and other factors to determine if the potential borrower not only meets the requirements for a mortgage,. Expertise in private equity real estate underwriting, structuring, and execution. At the national association of mortgage underwriters we offer a comprehensive mortgage underwriter bootcamp which includes online mortgage training classes to mortgage.. Learn how to analyze cash flows, leases, valuation, and loan performance of cre properties for underwriting. Gain tangible skills when you enroll in the certified residential underwriter (cru) certificate and designation program. At the national association of mortgage underwriters we offer online mortgage underwriting training, certification and education. Completion of this program along with the prerequisites results in the award. Strong multifamily background is preferred, however candidates with expertise in other asset classes (office,. This online course reviews the. Learn how to analyze cash flows, leases, valuation, and loan performance of cre properties for underwriting. Learn how to underwrite more complex real estate deals involving office, retail, and industrial loans. Real estate agent tipsfree coaching call220 new millionaires madecoaching since. Gain tangible skills when you enroll in the certified residential underwriter (cru) certificate and designation program. Acquire the specialized lending skills to structure real estate construction loans and. A mortgage underwriter must analyze a potential borrower's income, assets, liabilities, and other factors to determine if the potential borrower not only meets the requirements for a mortgage,. Earn a mortgage underwriter. Our robust catalog of programs offers a variety of courses on underwriting to help your team develop and hone the skills necessary to tie all of the components of underwriting together to. Learn how to analyze cash flows, leases, valuation, and loan performance of cre properties for underwriting. At the national association of mortgage underwriters we offer online mortgage underwriting. Campusunderwriter® is the online mortgage training provider for the national association of mortgage processors® (namp®) and the national association of mortgage underwriters®. This online course reviews the. Designed for commercial lenders and credit analysts who need training on. Dedicated career guidancerespected degreeflexible formats Earn a mortgage underwriter certification! Campusunderwriter® is the online mortgage training provider for the national association of mortgage processors® (namp®) and the national association of mortgage underwriters®. The analyst will look at the borrower's. Up to 10% cash back real estate analyst and underwriting is the process of reviewing a loan application to determine the amount of risk involved. Designed for commercial lenders and credit. Learn how to underwrite more complex real estate deals involving office, retail, and industrial loans. Learn how to analyze cash flows, leases, valuation, and loan performance of cre properties for underwriting. Strong multifamily background is preferred, however candidates with expertise in other asset classes (office,. 5+ years of commercial real estate underwriting experience, or equivalent demonstrated through one or a. Campusunderwriter® is the online mortgage training provider for the national association of mortgage processors® (namp®) and the national association of mortgage underwriters®. 5+ years of commercial real estate underwriting experience, or equivalent demonstrated through one or a combination of the following: Perform simple, preliminary development project evaluations from start. Designed for commercial lenders and credit analysts who need training on. Up to 10% cash back real estate analyst and underwriting is the process of reviewing a loan application to determine the amount of risk involved. At the national association of mortgage underwriters we offer online mortgage underwriting training, certification and education. Cre underwriting 101 in the pioneer realty capital school of commercial real estate finance is a cornerstone lesson in underwriting for commercial real estate. As you work your way through the. This online course reviews the. Expertise in private equity real estate underwriting, structuring, and execution. Acquire the specialized lending skills to structure real estate construction loans and. Earn a mortgage underwriter certification! Our robust catalog of programs offers a variety of courses on underwriting to help your team develop and hone the skills necessary to tie all of the components of underwriting together to. This progressive curriculum establishes the standard of training for residential underwriting professionals. Our progressive curriculum establishes the standard for professional excellence in residential mortgage loan underwriting. A mortgage underwriter must analyze a potential borrower's income, assets, liabilities, and other factors to determine if the potential borrower not only meets the requirements for a mortgage,.Streamlining Real Estate Investments with Underwriting

Underwriting Definition Real Estate License Wizard

The Ultimate Guide to Commercial Real Estate Underwriting

Multifamily Real Estate Underwriting Essential Steps for Beginners

Underwriting Office Properties Online Certificate Training Course PRC

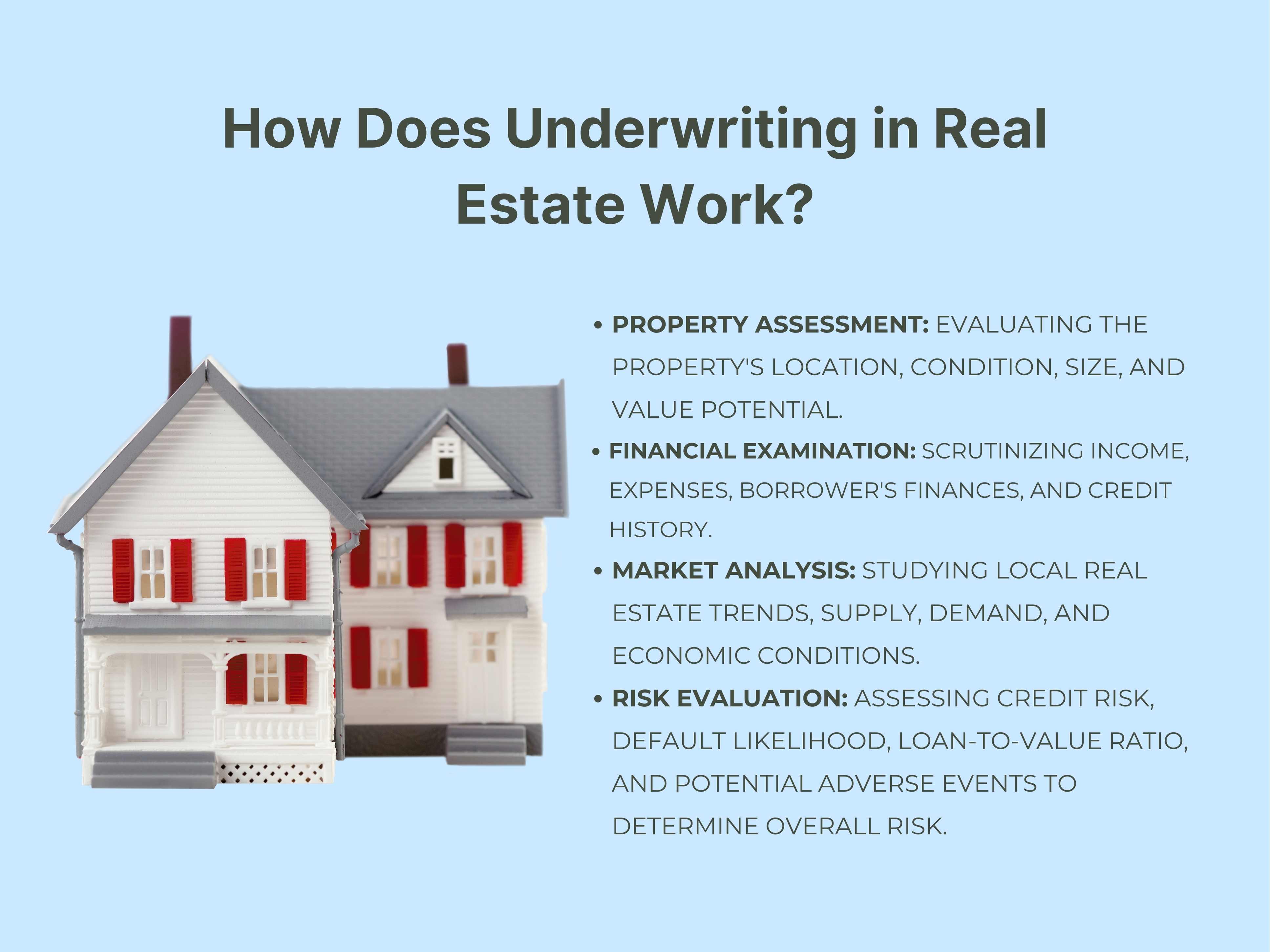

Underwriting in Real Estate A Comprehensive Guide

Underwriting Multifamily Properties Online Certificate Training Course

Underwriting in Real Estate A Comprehensive Guide

A 7Step Framework For Underwriting Commercial Real Estate Break Into CRE

An Insight into Real Estate Underwriting Real Estate

Learn How To Analyze Cash Flows, Leases, Valuation, And Loan Performance Of Cre Properties For Underwriting.

The Analyst Will Look At The Borrower's.

Dedicated Career Guidancerespected Degreeflexible Formats

At The National Association Of Mortgage Underwriters We Offer A Comprehensive Mortgage Underwriter Bootcamp Which Includes Online Mortgage Training Classes To Mortgage.

Related Post: